At the end of every year I like to look back at the biggest stories that made news in the previous 12 months. As the sun sets on 2015, it will be remembered as a banner year for marketplace lending with all the major players experiencing a great deal of success. The rapid growth continued unabated, many new partnerships were forged, new innovations developed and many new entrants launched.

It was a year with countless big stories. Below are my top 10 news stories that we published on Lend Academy in 2015.

1. An In Depth Look at the OnDeck/JPMorgan Chase Deal

This was the biggest story of the year in my opinion. We have this country’s largest bank, Chase, partnering with our industry’s largest small business platform, OnDeck. Chase decided they did not have the expertise or the inclination to build an operation themselves, so they have partnered with OnDeck to provide the underwriting engine and servicing for small business loans that Chase might not otherwise make. More coverage of this story is in The Wall Street Journal.

2. A National Tragedy With a Link to P2P Lending

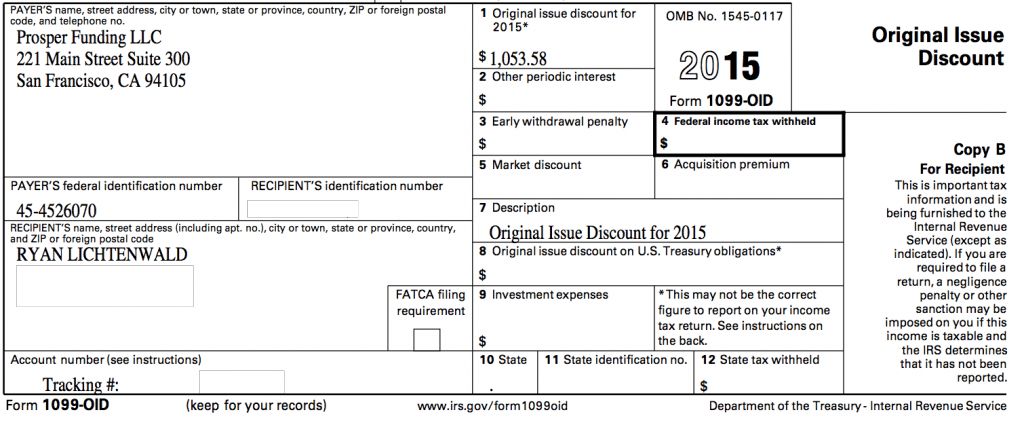

This article is near the top of my list, not because I think it is a significant story in itself, but because it was so widely reported. The mainstream press covered the story of the San Bernardino shooters taking out a Prosper loan more than any other story in our industry’s history. There were literally thousands of articles written about this, many with glaring inaccuracies unfortunately, so I felt the need to set the record straight. More coverage of this story is in Bloomberg.

3. Goldman Sachs Is Entering P2P Lending Becoming the 1st Bank to Launch a Platform

I don’t think many people, myself included, expected the first major bank to build their own online lending platform to be Goldman Sachs. Even though this story is from June there has still been no official announcement from the firm but they appear to be building out their platform and readying for a launch some time in 2016. More coverage of this story is in The New York Times.

4. Responses from the Treasury RFI on Marketplace Lending

This past summer the U.S. Treasury sent out a request for information on marketplace lending. They asked 14 quite detailed questions and received over 100 responses including the thoughts from most of the major players in the industry. More coverage of this story is in The Wall Street Journal.

5. Madden 2015 Has Nothing to Do With Football

The Madden v. Midland case had nothing directly to do with marketplace lending but its implications are already being felt by many platforms. The core issue here is whether interest rates charged on a loan by an issuing bank can be exported across state lines when a loan is sold. Given every state has different usury limits this can be an issue when the rate charged is above another state’s usury limit. Which is what led to Madden v. Midland. The case has now been sent to the U.S. Supreme Court. More coverage of this story is in Bloomberg.

6. SoFi Raises $1 Billion and Continues to Shake up the Industry

There were a lot of big funding rounds announced this year but none were bigger than the SoFi announcement of a $1 billion round from SoftBank Capital. The equity round was the largest ever by a fintech company and cemented SoFi as a leader in marketplace lending. But as CEO Mike Cagney pointed out in our interview, SoFi is about far more than just lending – they want to shake up many areas of financial services. More coverage of this story is in Bloomberg.

7. Lending Club Signs a Deal With a Consortium of 200 Community Banks

The partnership between Lending Club and BancAlliance, announced in February, is a big deal for both Lending Club and the 200 community banks in BancAlliance. Community banks, in many ways, have the most to gain by partnering with marketplace lending platforms. They can offer new loan products to their members as well as provide a diversified investment opportunity for their deposit holders. More coverage of this story is in The Wall Street Journal.

8. Prosper Makes its Second Acquisition, a Personal Finance Company Called BillGuard

When I first heard about this story I didn’t see Prosper’s logic in acquiring BillGuard, a a personal finance analytics company based in Israel. But as I thought more about it I realized that this deal provides Prosper with something that few marketplace lenders have: a valued added offering to engage potential borrowers before they need a loan. More coverage of this story is in The New York Times.

9. CreditEase’s Online Platform Yirendai Becomes the Third Major P2P Lender to IPO and China’s First

We have reported many times here on Lend Academy that China is the largest and most innovative market in the world for P2P lending. Just before Christmas we had the largest P2P platform in the world, CreditEase, conduct an IPO on the New York Stock Exchange, for their online lending division Yirendai. More coverage of this story is in The Wall Street Journal.

10. Fundrise Launches First Ever eREIT To Invest In Commercial Real Estate

Retail investors have continued to get a raw deal as marketplace lending has taken off. The only real options for investors have been Lending Club and Prosper. With this announcement from Fundrise everyday investors can now invest in commercial real estate through their new eREIT. More coverage of this story is in Wired.

One of the big stories of the year that didn’t make the list was the Lending Club partnership with Citi. This was announced at LendIt USA 2015 and we were so busy with LendIt we were not able to cover this story in depth on Lend Academy. We also didn’t cover some of the groundbreaking securitization deals that happened this year as the number of these new deals skyrocketed.

Happy New Year everyone. I hope you have an enjoyable long weekend and all the best for 2016. It is going to be another fascinating year.

The post The Most Important Marketplace Lending News Stories of 2015 appeared first on Lend Academy.